2025 Irs Business Mileage Reimbursement Rate

2025 Irs Business Mileage Reimbursement Rate. The internal revenue service (irs) has released the optional standard mileage rate for 2025. The irs has announced the standard mileage rate for 2025:

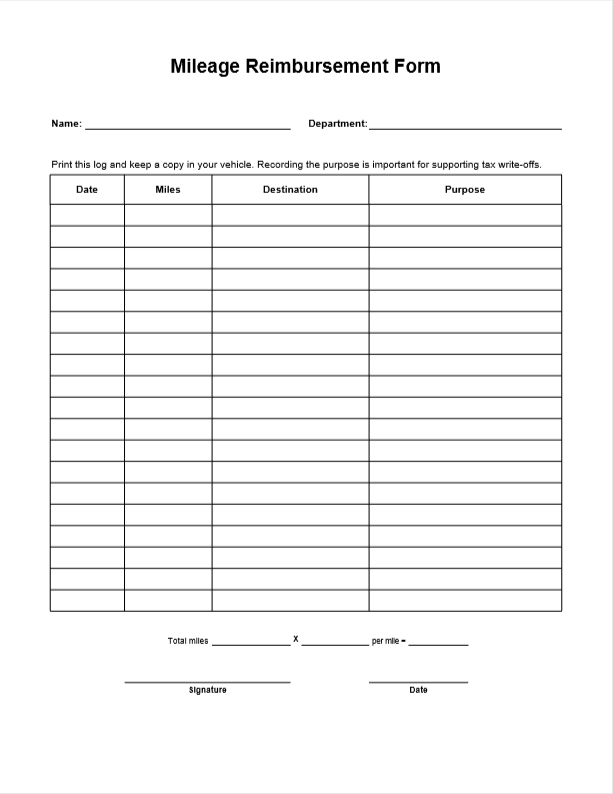

The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents per mile for moving or medical. The irs is raising the standard mileage rate by 1.5 cents per mile for 2025.

Irs Mileage Rate 2025 Include Gas Caro Martha, This rate reflects the average car operating cost, including gas, maintenance, and depreciation.

What Is The 2025 Irs Mileage Reimbursement Rate Connie Constance, 67 cents per mile for business purposes.

What Is Irs Mileage Rate 2025 Mari Orelle, Effective january 1, 2025, the irs standard mileage rate for business use of a vehicle is 67 cents per mile.

Irs Business Travel Mileage Rate 2025 Allys Sydney, Each year, the irs sets optional standard mileage rates as a simple.

IRS Mileage Reimbursement Rate 2025 All You Need to Know about the 1., Page last reviewed or updated:

IRS Mileage Reimbursement Rate 2025 Know Rules, Amount & Eligibility, Effective january 1, 2025, the irs standard mileage rate for business use of a vehicle is 67 cents per mile.

IRS Increases Business Mileage Rate For 2025, The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents per mile for moving or medical.

IRS Mileage Rates 2025 What Drivers Need to Know, This rate reflects the average car operating cost, including gas, maintenance, and depreciation.